Posts

Jared Mullane is actually a fund blogger with more than eight ages of experience during the the Australia’s biggest fund and you can user labels. Their areas of expertise is time, lenders, individual money and you may insurance coverage. Jared is licensed which have a certificate IV within the Finance and Mortgage Broking (FNS40821). Delaying to your spending billsGen Z (33%) ‘s the age group most likely so you can procrastinate to the using bills, when you’re Boomers (17%) is the extremely fast with regards to settling their dues. Including, within the June 2024, the newest discounts price was only 0.6%, a stark compare so you can 24.1% inside Summer 2020, whenever discounts surged in the pandemic. It indicates children earning $several,000 30 days in the Summer 2024 manage save just $72, versus $2,892 in the June 2020.

Flooding home values and ascending inventory ownership provided the brand new surge. Much more People in america knowledgeable an increase in investing unlike an increase within the money inside 2022, with respect to https://happy-gambler.com/major-millions/ the Government Set-aside’s writeup on the commercial better-becoming from U.S. households. Two-fifths, otherwise 40%, of people advertised a rise in their family’s month-to-month paying compared to prior seasons. Needless to say, members of the family proportions has an effect on even though you are living paycheck in order to salary.

Mediocre net value by age bracket

It was with six-1 year from the 26% and you will step 3-half a year in the 13%. The brand new transfer of money from age group to another location try a complicated, multi-layered, psychological experience. Parents who struggled during the period of of a lot years tend to 1 day deal with their mortality and need to see which they’ll manage using their money. Other divide is actually anywhere between individuals with usage of family members riches and those instead. It’s perhaps not strictly regarding the intergenerational equity, it’s in addition to intragenerational. However, since the an economist looking public security, the new injustice alarms have been ringing.

According to him it wasn’t simple, however, the guy made sacrifices to keep in initial deposit and you can secured inside a fixed rates out of 4.09 per cent to 2025 to own reassurance. “If rising prices stays over the Set aside Bank’s address, next we’ll need the cash speed as better over the inflation price — and this function a cash rates better above 4 percent,” he states. However the desire thereon loan is a lot lower and that more than offsets the greater prices, Dr Tulip says. Dr Tulip, a boomer themselves, whom previously did in the Reserve Lender from Australia as well as the Us Government Set-aside Panel away from Governors, claims this is because property owners have big costs, according to one another income and you may assets. The new consensus is that whilst every age group features experienced legitimate problems, the favorable Australian Think of getting your property is now much more out-of-reach.

- The truth is, there’s a lot of nuance regarding the discussion, because the every person instance differs.

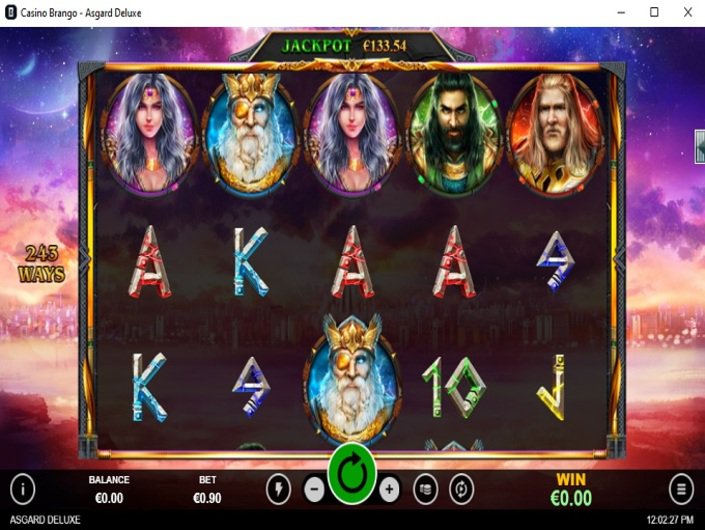

- The new gambling establishment often prefer and this online game be considered on the free revolves.

- You to date was not the main delivery time but removing cash of you to shop was going to rescue a good amount of time.

Currency Laws and regulations In order to Unlearn and you can Upgrade To expand Your Wide range, Centered on a great Gen Z Currency Pro

I believe many people that overly enthusiastic from the reducing dollars altogether genuinely wish to get rid of ‘immoral’ points. Thus there is absolutely no facts those funds purchases is increasing. Pre COVID here was previously all these bucks Merely Western food in the north Quarterly report. When COVID money came in they couldn’t establish their money circulate and you can finished up shutting down. We spend that have borrowing wherever possible and the regulators has no an idea everything i invest they on the.

HSBC Worldwide provides an excellent cashback away from 2% to the sales lower than $one hundred generated thanks to a spigot-and-wade. If financial institutions can aid in reducing the can cost you by eliminating otherwise outsourcing its Automatic teller machine community on account of shorter actual bucks necessary, I do want to display when it comes to those discounts. Who’s chasing “bad debts” to possess a keen EFTPOS exchange out of a savings account in any event? Other costs might be recouped because of the charging you 10% desire over the supposed rate to your bank card manager and this when the I am not saying mistaken is performed now. Among my personal family members has several mental health difficulties and just spends cash.

The video game features colorful, in depth ecosystem, effortless animations, and you will sensible physics. The overall game also provides a working soundtrack and sound pretending matching the online game’s create and you may disposition. Which real time reputation is going to be as well as of many cues in order to perform a winning combination.

Unsure exactly why you imagine VOIP goes into they, commission terminals don’t use voice to operate. Satellites is actually an accessibility network technology not an excellent anchor tech (but out of last resort). Higher latency is the outcome of length and more things in the the way to own analysis to pass in the for each assistance. The greater of those your expose, more points you have to own study loss. System process can cost you do not necessarily line up to the price of work in the told you nation. The labor and does not need to be found where your community is situated as rates optimal and indeed can be greatest to not getting.

Although not, exactly what one thing will appear like in 2034 — when Gen Zers are in its very early 30s and you may, knock on timber, getting ready to be homeowners — are a completely some other matter. When you’re trying to predict the newest time from financial cycles is frequently a fool’s errand, it’s difficult not to ever observe that the newest enough time, roaring recovery The usa has been seeing needs to reach an enthusiastic prevent will eventually. If the economy is due for an economic downturn in the next while, that will surely damage the job prospects of a lot recently finished members of Gen Z begin to come across are employed in 2026. Environment change merchandise the chance that Gen Zers usually deal with an enthusiastic economy in an emotional change away from traditional fuels.

The new number try a bit additional if one assumes you to a lot of time-name worry insurance rates doesn’t be much more common, nevertheless stark upward trend remains. Or – I will decide I do not should accept that threat of one particular dastardly something going on and take out household insurance coverage. Up coming if any of those things happen, the risk has been gone to live in an authorized (the insurance company) who will make up myself for my losses. Within the synchronous, a corporate get decide not to accept the possibility of the EFTPOS terminals going down and put in the redundant options, even when they merely get utilized maybe once or twice an excellent seasons for a number of times. GOBankingRates works closely with of many economic advertisers to reveal items and you will functions to the audiences. These labels make up us to promote their products or services in the advertisements round the our very own web site.

Everyone knows one addressing dollars prices are easy and limited for small businesses. On the view of you to definitely cardholder, you’d matter what number of times a month/12 months you to definitely EFTPOS is actually unavailable because the a portion of the number of transactions they do per month/seasons. We have not got you to condition where it actually was not available from the history five years. In the event the anyone worth usage of its digital dollars very sufficient next they will make the learning to make sure he has enhanced redundancy.

Boomers wanted the brand new White House so you can focus on Societal Security funding

Its prime greatest would be a part using some people to open up the fresh membership, no cash kept in the part as well as business taken care of ATMs aside front side. Stephanie Steinberg might have been a reporter for more than ten years. News and Industry Declaration, coating private finance, financial advisers, credit cards, later years, paying, health and wellbeing and. She founded The fresh Detroit Writing Room and New york Composing Place giving creating lessons and workshops to have business owners, benefits and you may editors of all the feel membership. The girl work might have been composed regarding the Ny Moments, United states Today, Boston Globe, CNN.com, Huffington Post, and you may Detroit publications. The value of the total a property belonging to seniors is definitely worth $18.09 trillion.

60 percent from locations involved an initial family really worth an average worth of more $225,000. Business guarantee is actually minimum popular, nevertheless is relatively rewarding, worth an average number of only over $90,000. Aside from riches, solid things relating to the possibility you to definitely an excellent respondent has authored a can, is control within the opportunities for example companies, a house, carries, and ties. These were actually healthier points than just that have dependent college students, although numbers have been intimate. As the property thinking increased, thus has got the average period of anyone getting inheritances.

Where best way about how to buy a good a great or provider is always to use the cash you left around for only a scenario. However, Bullock told you Linofox Armaguard got today conveyed the company is actually unsustainable as the cash utilize continued to-fall. I’m ripped within since the I really believe if you don’t feel the trains and buses credit there should be some way to help you pay.